Welcome to todays post where I’ll be exploring the little understood Bitcoin and how to make extra money by mining it.

You’ve probably heard about Bitcoin before – it’s that hot new digital currency that’s been dominating headlines. But how are new bitcoins created in the first place? This is where Bitcoin mining comes in.

Bitcoin mining is the process that adds new blocks to the blockchain and mints new bitcoins. It involves using specialized computer hardware to solve complex math problems that validate transactions on the Bitcoin network.

As a miner, you’re essentially providing a service that keeps the Bitcoin ecosystem running smoothly.

In exchange for lending your computer’s processing power to secure and uphold the integrity of Bitcoin’s public ledger (the blockchain), you are rewarded with newly minted bitcoins by the network.

It’s like being paid in bitcoin to be a validator and accountant for Bitcoin!

Why Bitcoin Mining Matters

Mining not only unveils new bitcoins, it’s an essential function that protects the Bitcoin network. Bitcoin mining decentralizes power on the network by making sure no single entity can control the blockchain. This builds security and trust in the system.

As more miners contribute their processing power to validate transactions and secure the network, they make it more resistant to attacks.

This also makes fraudulent transactions unlikely since altering past blocks requires tremendous computing power. By mining, you help make Bitcoin a stable global currency.

Earn Extra Income by Mining Bitcoin

When you mine bitcoins, you can earn money without investing upfront or taking financial risks. Bitcoin miners receive bitcoin as a reward when they confirm batches of transactions to the blockchain. This gives you a steady stream of income in bitcoin that you can hold long-term as an investment or convert to cash.

The mining payouts can cover the cost of electricity and equipment over time and even generate pure profit.

As Bitcoin appreciates in value long-term against USD and other currencies, the bitcoins you earn could be worth more and more. Many miners consider mining as a side-hustle to make ends meet.

What is Bitcoin Mining?

As mentioned earlier, Bitcoin mining is the process of verifying transactions on the Bitcoin network and securing the public ledger (blockchain).

Miners use specialized hardware and software to solve complex mathematical puzzles that validate groups of transactions called blocks.

Solving these cryptographic puzzles proves the miner put in the computational work required. When a miner solves a block’s puzzle, they get to add the verified block to the blockchain and receive bitcoin in return.

This bitcoin is both the reward and incentive for miners to keep contributing their computing power to the network.

How Does Bitcoin Mining Work?

Bitcoin mining works like a lottery that runs every 10 minutes. Multiple miners compete to be the first to find the solution (called the “nonce”) to a numeric problem tied specifically to the candidate block they’re working on.

Whoever solves for the nonce first wins the round and gets to add that block to the blockchain then receive the bitcoin reward.

Finding nonces requires vast numbers of calculations using high-powered hardware. The miner who solves the math problem uses the nonce to generate a “proof of work”.

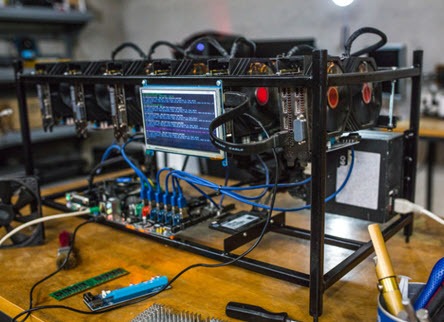

Hardware and Software Needed

Specialized Bitcoin mining hardware called ASICs (application-specific integrated circuits) are designed just for mining bitcoin based on a proof-of-work algorithm.

They far outperform CPUs and GPUs. ASIC miners are constantly improving, becoming faster and more energy efficient over time. You’ll need an ASIC miner along with mining software tailored to your hardware.

Mining Methods

There are different ways you can mine Bitcoin:

- Solo mining – Mine by yourself and keep all the rewards if you solve a block

- Pool mining – Combine computing power with other miners in a ‘pool’ and share block rewards based on contribution

- Cloud mining – Purchase a mining contract from a cloud provider instead of setting up your own hardware

Risks and Challenges

Like any endeavor, Bitcoin mining comes with risks and learning curves:

- Hardware or software failures can compromise operations

- Electricity costs can take up significant portions of earnings

- Changes in Bitcoin’s value affects profitability and ROI

- ASIC miners can quickly become obsolete as faster models emerge

- Mining difficulty increases over time as more miners contribute hash power

I’ll be covering strategies to address these risks across the guide. Next we’ll look at actually getting started with Bitcoin mining step-by-step.

Setting Up a Bitcoin Wallet

The first step is to set up a Bitcoin wallet to store coins you’ll earn from mining. Software wallets like Electrum or hardware wallets like Trezor that give you control of private keys are preferred for security. Avoid keeping coins in exchange wallets long-term.

Make sure to safely back up your wallet recovery phrases in case you need to restore access. Your mining proceeds will go to the wallet’s public address.

Choosing Mining Hardware

Specialized ASIC miners will yield the best results and ROI compared to GPUs. They are specifically designed just to mine Bitcoin based on its SHA-256 algorithm.

Newer and more energy efficient models keep emerging so research thoroughly before buying one.

Compare factors like hash rates, power usage, voltages, clock speeds and cost. Popular ASIC models include the AntMiner S19 Pro or the WhatsMiner M30S++.

Selecting Mining Software

Your ASIC miner will need compatible mining software like CGMiner or BFGMiner. These allow monitoring and optimizing your hardware’s performance.

Many mining pools have their own software that automatically configures with the pool. Factors to consider include supported operating systems, ASIC compatibility, ease of use, monitoring capabilities, and added features.

Solo Mining vs Mining Pools

You can either mine solo with just your own hardware or join forces with other miners in a pool to increase earning potential.

Solo mining promises to keep the full block reward if you solve a block, but has inconsistent, unpredictable payouts.

Pool mining uses combined computational power with others to mine as a team, providing smaller but more frequent payouts for your contribution.

For most DIY miners, pools are lower risk and more reliable source of income.

Calculating Profitability

You want to crunch projected profits based on mining hardware, electricity costs, pool fees, current bitcoin price and mining difficulty.

Compare potential returns across different ASIC models using profitability calculators online. This helps assess ROI timeframes and find the break-even point. Re-evaluate profitability often as Bitcoin price and mining dynamics shift.

Next is a crucial step – actually setting up your mining operation’s hardware and software.

Setting Up Mining Hardware

Once you select ASIC mining hardware, carefully unpack and assemble the components based on the instruction manual.

This may involve connecting cables, configuring IP addresses, installing power supplies and more. Proper setup is key for performance and longevity.

If needed, tweak settings like voltage, fan speeds and clock rates to optimize operations. Monitor the ASIC miner’s interface to track metrics like hash rate, temperature, and error rates. Ensure it connects to the internet and the fans run smoothly without overheating.

Installing Mining Software

With your mining hardware assembled, it’s time to install compatible mining software by importing miners’ firmware or running quick installers. Configure the software to point toward your desired Bitcoin wallet address to receive earnings.

Enable any performance tuning or overclocking features to maximize hash rate. Set up monitoring features like status logs, temperature sensors, hash rate displays and remote interfacing so you can keep tabs on your miner from other devices.

Joining a Mining Pool

Register for a mining pool service that aligns with your goals and hardware capabilities. Larger pools offer more frequent payouts but smaller rewards. Join based on the pool’s fees, minimum payouts, reputation and ease-of-use.

Configure your mining software to connect to the pool. Some pools have custom software that handles this automatically. Input your wallet address to receive payments for your contributed mining power.

Troubleshooting Common Issues

- If hash rate seems low, check miner connections and reboot.

- If overheating, improve ventilation or reduce overclocking.

- Use mining pool tech support channels to diagnose software issues

- Adjust settings to reduce stale shares or rejected hashes

- Ensure mining software and firmware is kept updated

Staying on top of small issues prevents bigger problems down the line! Let’s turn now to best practices for managing your ongoing mining operations.

Monitoring Mining Rig Performance

Actively check in on your mining rig’s vital signs like hash rates, hardware errors, stale shares, pool-side stats, bitcoin earnings, and current profitability.

Set up notifications and alerts when key metrics fall outside ideal ranges. This helps spot problems early which is crucial for a smooth operation.

Mining dashboard software makes it easier to monitor multiple ASIC miners from one central point. Use performance analytics over time to tune operations.

Track how adjustments like overclocking affect stability and hash rates to find the optimal settings.

Managing Expenses

Electricity is likely your highest ongoing cost. To control expenses:

- Use energy efficient ASIC models and PSUs

- Connect rigs to solar power or lower-cost energy sources

- Run rigs only when profitable based on energy costs

- Enable automatic shut off features during peak rate hours

Also account for costs like internet, hardware replacements, repairs, rental space (if applicable) and pool fees. Calculate precisely how total expenses impact your net profits.

Maximizing Profits

- Consistently analyze if mining with current hardware remains profitable

- Upgrade to better ASIC models when possible

- Move between pools and explore how different payout schemes impact earnings

- If electricity is too high to profit, consider colocation or hosted services

- Take advantage of tax deductions related to your mining business

Staying Informed

Actively keep tabs on developments regarding Bitcoin price forecasts, changes in mining difficulty, new ASIC models, regulatory issues, and blockchain innovations. This will help you make smart decisions.

Subscribe to mining blogs, join forums and connect on social channels to exchange ideas and learn from peers. Continuing education ensures you don’t get left behind by fast industry changes.

Protecting Mining Hardware

Since specialized ASIC miners are expensive, it’s wise to safeguard them from potential damage or theft.

- Store mining rigs in a safe, clean, climate-controlled environment

- Keep rigs in a space with restricted access – use locks if needed

- Install surge protectors and fire suppression equipment

- Handle equipment with proper antistatic measures

- Ensure rig frames are stable and parts securely mounted

Take precautions based on your mining location’s particular risks. Maintain vigilance against water leaks, dust, extreme weather, or tampering.

Securing Your Bitcoin Wallet

Apply best practices for safeguarding your wallet’s private keys, recovery phrases and access credentials since this guards your earned bitcoin.

Actions like enabling 2-factor authentication, avoiding online storage of recovery phrases, and using offline wallet signatures all reduce chances of funds being compromised if your network is breached.

Hardening Mining Operation Security

Since mining rigs run non-stop, it’s paramount to protect against cyber intrusions like hacked credentials or malware that could propagate across your network.

Wise precautions include:

- Installing reputable antivirus/firewall software

- Frequently updating operating systems and mining software

- Avoiding risky downloads or email attachments

- Monitoring traffic on your network for signs of unauthorized access attempts

- Using VPN connections and proxy services when possible

Additionally consider physical security like surveillance cameras in your mining space.

Cloud Mining Services

Instead of managing your own hardware, cloud mining enables you to rent hash power from data centers with shared mining rigs. Companies like Genesis Mining and IQMining operate these services.

Upfront costs are lower since you’re not buying equipment. But profit margins are trimmed by recurring fees plus the mining provider’s cut. Vet cloud services carefully to ensure transparency and reliability.

Mining Other Cryptocurrencies

Rather than only mining Bitcoin, look into mining cryptocurrencies like Litecoin, Monero or Ethereum which can also generate income.

The mining process works similarly in verifying transactions to earn crypto – but uses different proof algorithms and hardware types tailored to each coin.

Research prospects thoroughly as profitability differs across currencies based on factors like coin price, mining difficulty, hardware needs etc.

Some up and coming coins are still economical for hobbyists to mine using GPU rigs vs costly ASICs.

Mining Contracts and Share Deals

Investors wanting exposure to crypto mining returns without the tech overhead can buy shares in mining contracts.

Companies sell varying lengths of cloud mining contracts where you obtain a share of the returns based on your initial payment.

Reputable firms will also let you resell unused part of contracts on exchanges. Evaluating hosted mining deals require analysis around contract obligations, maintenance fees, upfront costs, profit limiting risks and potential resale value.

Understanding Bitcoin’s Legal Status

Depending on where you reside, Bitcoin’s classification and relevant laws around mining or trading cryptocurrency vary widely across state, provincial and national jurisdictions.

Some define bitcoin as a commodity while others treat it as currency or property. A patchwork of evolving regulations apply to activities like running mining operations, reporting income, paying taxes, converting/trading coins and more.

Research particular statues and legal guidance within the jurisdictions you reside and operate in regarding the status and treatment of virtual currencies.

This is key for ensuring you comply with applicable laws and avoid fines or licensing issues. Consider consulting a lawyer specializing in cryptocurrency compliance to clarify obligations in your specific situation.

Reporting and Paying Taxes

In many countries, bitcoin or cryptocurrencies like those earned through mining are treated as taxable income or capital gains when sold or converted to fiat currency.

Stay current on policies dictating how mining proceeds, expenses, trading gains/losses need to be recorded and reported, as well as tax rates that apply for individuals or businesses.

Maintain detailed records of mining-related income, costs and transactions which are typically needed to calculate taxes owed.

Consider automated tax filing assistance from crypto-savvy accounting firms to streamline reporting especially if managing multiple mining rigs.

Ensure you set aside sufficient cash reserves to pay capital gains or income tax obligations at fiscal year-end related to your mining venture.

Complying with Regulations

Depending on scale or business structure, additional rules can dictate licensing requirements like money transmitter permits, know-your-customer (KYC) and anti-money laundering (AML) policies if providing transactions services, plus cybersecurity safeguards. Failure adhere can trigger stiff penalties or legal repercussions from authorities.

Conclusion

We’ve covered a lot of ground when it comes to Bitcoin mining – from understanding how it works to the hardware, software and methods required as well as managing real-world operations, taxes, expenses and alternatives.

The key points include:

- Bitcoin mining verifies transactions and mints new coins through solving complex math puzzles, supporting the network’s integrity

- Specialized ASIC hardware delivers far faster hash rates and efficiency than GPUs or CPUs

- Miners can operate solo or often have better results joining a pool to smooth out inconsistent payouts

- Getting started requires calculating profit projections, securing wallet storage and configuring software aligned with your goals

- Proper setup, monitoring and troubleshooting keeps operations running smoothly

- Legality, regulations and tax obligations vary – do thorough research to remain compliant

Earning Potential via Bitcoin Mining

Despite increasing mining difficulty and hardware expenses, Bitcoin mining remains a viable way to generate supplementary income by confirming network transactions in exchange for newly minted coins. Cloud services and mining pools help casual miners overcome barriers to profitability.

Dedicated miners running optimized hardware and operations can achieve compelling returns on investment over time as Bitcoin appreciation outpaces equipment costs.

By learning the concepts in this guide, you now have the foundational toolkit to start your Bitcoin mining journey.

Exploring More and Staying Updated

Hopefully I’ve provided a comprehensive outlay for getting operational, yet Bitcoin mining has vast depth as a topic for hungry learners.

As for next steps, consider looking into the specific equipment models, mining pool offerings, cryptocurrency tax policies or blockchain mechanics that most interest you.

Actively educate yourself on the latest Bitcoin mining advances, innovations and best practices shared by communities online.

Don’t hesitate to ask questions and continue levelling up your knowledge so you can excel on your crypto mining adventure! I’ll be mining alongside you in spirit.